service tax new mexico

Log in or register. Introducting NM Taxation Revenue Department Notification Service.

New Mexico Retirement Tax Friendliness Smartasset

While New Mexicos sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

. B-20034 Delivered Groceries. Department of Workforce Solutions Unemployment Insurance Tax Bureau New Hire Directory. If sufficient time has passed for your return to be processed and you are still not able to review the status of.

Taxpayer Access Point TAP TAP is the Departments electronic filing system. Still others like Texas and Minnesota are actively expanding service taxability. Welcome to the Business Taxpayers pages of the New Mexico Taxation and Revenue Department.

Currently the state rate is 5125 percent for property and 5 percent for services and there are no municipal or county compensating taxes. Effective July 1 2021 the. The New Mexico Taxation and Revenue Department has substantially increased efforts to combat identity theft and refund fraud.

Delaware Hawaii New Mexico and South Dakota tax most services. Where to File addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in New Mexico during calendar year 2022. New Mexico Taxpayer Access Point TAP.

Your Online Tax Center. On these pages you should be able to find information you need to take care of. Corporate Income Franchise Tax.

You must file a state tax return and if required pay state taxes on your business income. Your Online Tax Center. Businesses that sell services across.

Welcome to Taxpayer Access Point. Tax Policy Advisory Committee meets Wednesday. New Mexico Taxation and Revenue Department.

Paper returns or applications for tax refunds are processed within 8 to 12 weeks. The Taxation and Revenue Department encourages all taxpayers to file electronically. The State of New Mexico Taxation and Revenue Department recently upgraded Taxpayer Access Point TAP.

Like the Federal Income Tax New Mexicos income tax allows couples filing jointly to. This page describes the taxability of. New Mexico collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

All NM Taxes Sidebar. The enhanced review process could increase the time it takes. Click Here to Subscribe.

Military are subject to the income tax but since 2007 active-duty military salaries have been exempt from the state. Delivered groceries may not be taxable. New Mexico businesses are liable for many different types of state taxes.

Regular military salaries of New Mexico residents serving in the US. New Mexico taxpayers can now make payments to the New Mexico Taxation and Revenue Department by telephone through a self-service option on the Departments Call.

Where S My Refund New Mexico H R Block

Home Taxation And Revenue New Mexico

Jury Duty Laws In New Mexico Juror Selection Qualifications And Dress Code

Finally Gst Goods And Services Tax Bill Has Been Passed In Rajya Sabha India We Would Be Hel Creative Advertising Goods And Service Tax Creative Branding

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

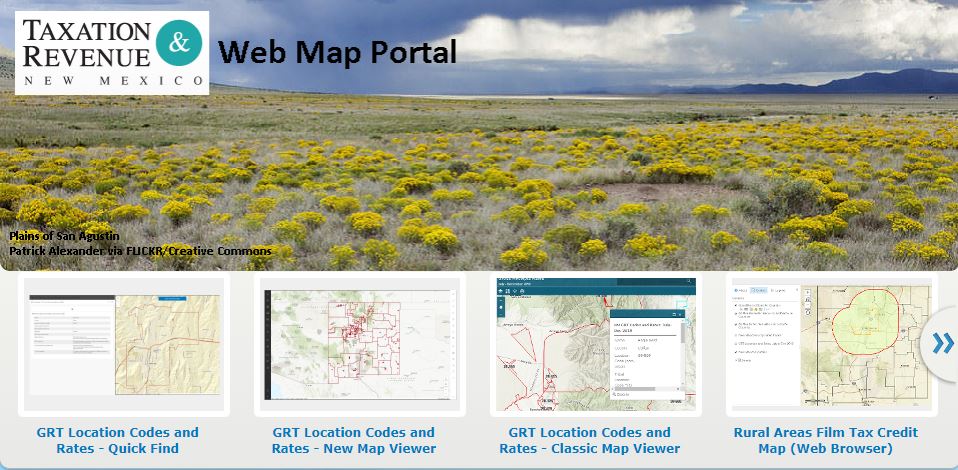

Gross Receipts Location Code And Tax Rate Map Governments

Online Services Taxation And Revenue New Mexico

State Income Tax Rates Highest Lowest 2021 Changes

Property Tax Division Taxation And Revenue New Mexico

New Mexico Retirement Tax Friendliness Smartasset

New Mexico Department Of Workforce Solutions Unemployment

New Mexico Personal Income Tax Spreadsheet Feel Free To Download Income Tax Income Tax

Your New Mexico Income Taxes Can Be Efiled Here At Efile Com

Online Services Taxation And Revenue New Mexico

Will Lopez Obrador S New Mexico City Airport Take Off Financial Times

State W 4 Form Detailed Withholding Forms By State Chart

How Do State And Local Sales Taxes Work Tax Policy Center